| Developer(s) | Intuit, Inc. |

|---|---|

| Initial release | 1984; 37 years ago |

| Operating system | Windows, Macintosh, Android, iOS |

| Type | Tax software |

| License | Proprietary |

| Website | turbotax.intuit.com |

TurboTax is a software package for preparation of American income tax returns, produced by Intuit. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct.[1] TurboTax was developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993.[2][3]

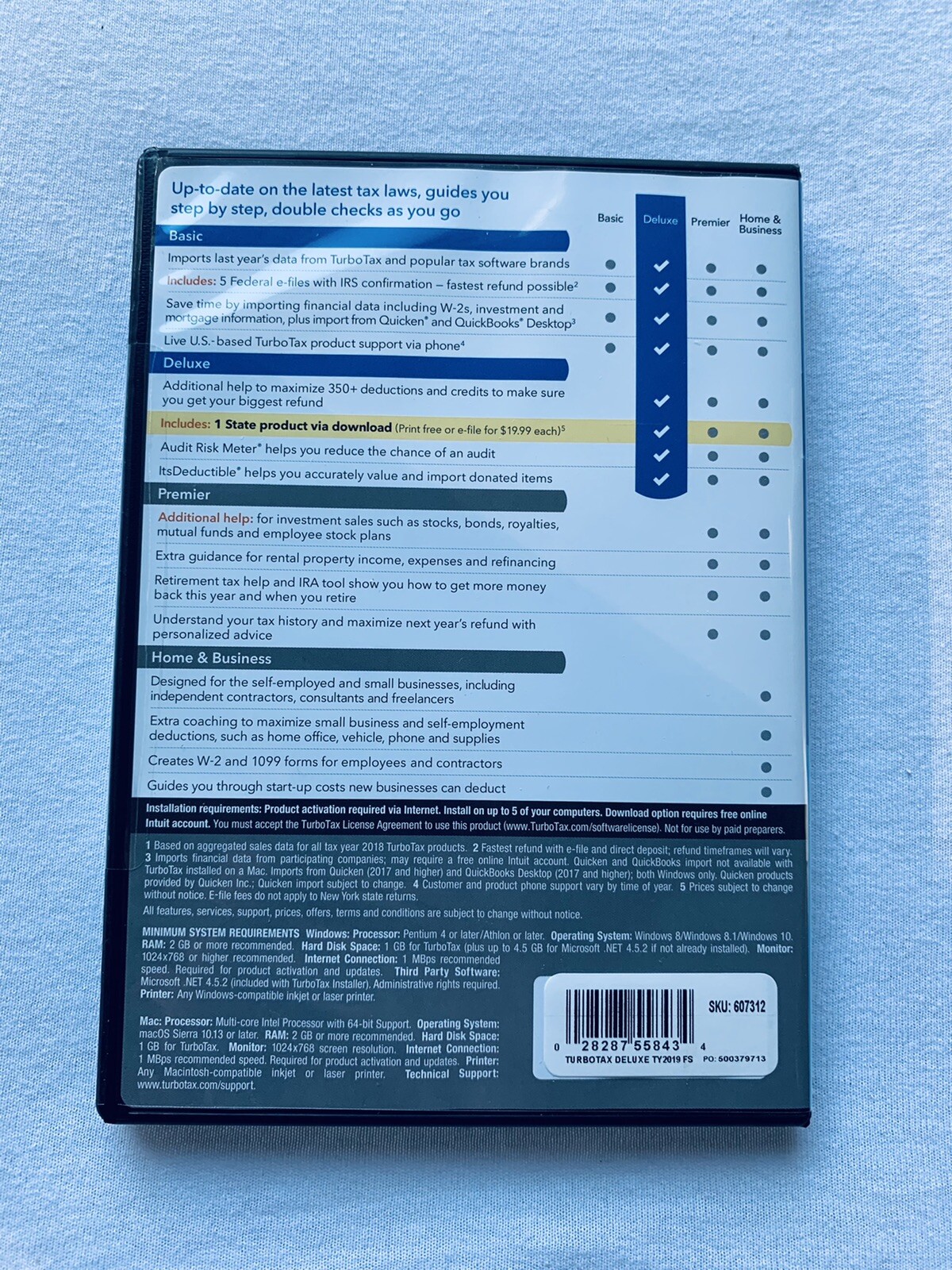

TurboTax Deluxe 2020 Desktop Tax Software, Federal and State Returns + Federal E-file (State E-file Additional) Mac Download Type: Tax Version: Deluxe & State Operating Systems Supported: Mac CD/Download Products Operating Systems macOS Mojave 10.14 or later. By Emma Johnson. Feb 07th 2021 12:27 am. Newegg is offering the TurboTax Deluxe + State 2020 Download for the best deal. Regular Price is $59.99. Choose a version. TurboTax Deluxe + State 2020 PC Download $34.99. TurboTax Deluxe + State 2020 Mac Download $34.99. TurboTax Premier + State 2020 PC Download $49.99. TurboTax Deluxe is recommended if: You own a home, have charitable donations to deduct, have high medical expenses, and only need to file a Federal Tax Return. TurboTax is tailored to your unique situation - it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. Includes 5 federal e-files.

Turbotax Deluxe Mac Download 2018

Intuit, the maker of TurboTax, has lobbied extensively against the Internal Revenue Service (IRS) creating its own online system of tax filing like those that exist in most other wealthy countries.[4][5][6] As part of an agreement with the IRS Free File program, TurboTax allows individuals making less than $39,000 a year to use a free version of TurboTax; a 2019 ProPublica investigation revealed that TurboTax deliberately makes this version hard to find, even through search engines, and that it deceptively steers individuals who search for the free version to TurboTax versions that cost money to use.[7] TurboTax has tricked military service members to pay to use the filing software by creating and promoting a 'military discount' and by making the free version hard to find when many service members are in fact eligible to use the software for free.[8] Intuit is under investigation by multiple state attorneys general, as well as New York's Department of Financial Services.[9][10]

Overview[edit]

Intuit Consumer Tax Group is based in San Diego, California.[11]Intuit Corporation, which owns Intuit, is headquartered in Mountain View, California.[12]

There are a number of different versions, including TurboTax Deluxe, TurboTax Premier, etc. TurboTax is available for both federal and state income tax returns. The software is designed to guide users through their tax returns step-by-step. The TurboTax software provides taxpayers additional support for their self-prepared returns by offering Audit Defense from TaxResources, Inc.[13]

Typically, TurboTax federal software is released late in the year and the state software is released mid-January to mid-February.[14] TurboTax normally releases its new versions as soon as the IRS completes revisions to the forms and approves the TurboTax versions, usually late in the tax year. The process is similar for states that collect income taxes.

In 2001, TurboTax saved financial institution passwords entered by users to servers at Intuit and the home computer.[15] The programming error was reportedly fixed, but as of 2012 TurboTax offers no option to download a data file directly from the financial institution. Instead, it prompts the user for their login name and password at the financial institution or permits the data to be entered by hand.[16]

In 2003, Intuit faced vocal criticism for its TurboTax activation scheme.[17] The company responded by removing the product activation scheme from its product. In 2005 TurboTax extended its offering by allowing any taxpayer to use a basic version of its federal product for free as part of the Free File Alliance. By 2006 that offer has been limited to free federal online tax preparation and e-file for taxpayers whose adjusted gross income is $28,500 or less (or $52,000 for those in the military) and those 50 or under. TurboTax has received a number of complaints regarding its advertising of the free version. For filers who use this basic version of the software, federal filing is free. However, state tax filing is not free, and the cost of using TurboTax to file state returns is not presented to the user until they've already completed entering their information for federal returns.

In 2008, Intuit raised the price of TurboTax for desktop customers by $15 and included a free e-filing for the first return prepared.[18] The company's new 'Pay Per Return' policy was criticized for adding a $9.95 fee to print or e-file each additional return after the first, including returns prepared for members of the same household. On December 12, 2008 the company announced that it had rescinded the new policy.[19]

On January 21, 2009, TurboTax received considerable public attention at the Senate confirmation hearing of Timothy F. Geithner to be the United StatesSecretary of Treasury. Geithner had testified that he used TurboTax to prepare his tax returns for the years 2001 to 2004 but had incorrectly handled the self-employment taxes due as a result of his being employed by the International Monetary Fund. Geithner made it clear that he took responsibility for the error, which was discovered in a subsequent IRS audit, and did not blame TurboTax. Geithner paid $42,702 in back taxes. Intuit responded by releasing a statement saying 'TurboTax, and all software and in-person tax preparation services, base their calculations on the information users provide when completing their returns.'[20]

International versions[edit]

Intuit also addresses Canadian tax returns with an entirely separate product also named TurboTax, but previously called QuickTax. The French version has retained its original name ImpôtRapide until 2017, when it was renamed TurboImpôt.

Controversies[edit]

Blocking search engines from indexing its 'free file program' page[edit]

Citizens of the US that make up to $72,000 per year are eligible for free preparation and filing of tax forms through the IRS Free File program.[21] However, TurboTax's 'free file program' page (https://turbotax.intuit.com/taxfreedom/) contains specific HTML tags (noindex, nofollow) which block search engines from indexing it.[22] TurboTax has been deceiving customers which were eligible for the free submission into signing up for their commercial product.[23] Starting December 30, 2019, under a new agreement from the IRS, TurboTax can no longer hide their free version services from search results.[24]

Writing to the boot track[edit]

The 2003 version of the TurboTax software contained digital rights management that tracked whether it had previously been installed on a computer by writing to sector 33 on the hard drive. This allowed it to track if it was on a computer previously, even through reinstalling the operating system. This also caused it to conflict with some boot loaders that store data there, rendering those computers unbootable.[25]

Opposition to return-free filing[edit]

Intuit, the owner of TurboTax, spent more than $11 million on federal lobbying between 2008 and 2012. Intuit 'opposes IRS government tax preparation', particularly allowing taxpayers to file pre-filled returns for free, in a system similar to the established ReadyReturn service in California. The company also lobbied on bills in 2007 and 2011 that would have barred the Treasury Department, which includes the IRS, from initiating return-free filing. An Intuit spokeswoman said in early 2013 that 'Like many other companies, Intuit actively participates in the political process.' She said that return-free filing had 'implications for accuracy and fairness in taxation.'[26][27] This led journalist Dylan Matthews to propose a boycott of the company in 2017.[28][29]

In its 2012 Form 10-K, Intuit said that 'We anticipate that governmental encroachment at both the federal and state levels may present a continued competitive threat to our business for the foreseeable future.'[26]

Repositioning of versions[edit]

In January 2015 it became known that the Deluxe version no longer supports IRS Schedules C, D, E, and F in interview mode. Although the Deluxe version still allows entry into those schedules by means of 'form mode', doing so may result in the loss of the ability to file electronically. In addition, the Premium version no longer supports Schedule C or F in interview mode. Intuit was widely criticized for these changes and responded with short-term mitigation, although it has not reversed the decision.[30] On February 5, 2015 Intuit sent a second email apology to current and former customers regarding the decision to remove specific schedules from the Deluxe and Premium versions. Intuit also apologized for their poorly received initial apology sent on January 27. In the February 5 message Intuit announced that they would reverse course in their 2015 Deluxe and Premium versions, including the schedules that were historically included in the software.[31]

Fraudulent return claims[edit]

In an article by Brian Krebs on February 15, 2015 it was reported that Intuit Inc. temporarily suspended the transmission of state e-filed tax returns due to a surge in complaints from consumers about refunds already claimed in their name.[32]

In a later article on February 22, 2015, Krebs reported that it was alleged by two former employees that Intuit knowingly allowed fraudulent returns to be processed on a massive scale as part of a revenue boosting scheme. Both employees, former security team members for the company, stated that the company had ignored repeated warnings and suggestions on how to prevent fraud. One of the employees was reported to have filed a whistleblower complaint with the US Securities and Exchange Commission.[33]

Diverting stimulus funds away from customers[edit]

In 2021, some individuals who used Turbotax for their tax filings were unable to access stimulus checks sent by the government because Turbotax diverted the checks to old and unused bank accounts for the customers.[34]

References[edit]

- ^Gray, Tim (February 11, 2012). 'Taking Tax Software for a Walk'. The New York Times.

- ^'Michael Chipman'. People. Forbes. April 18, 2012. Archived from the original on May 16, 2009. Retrieved December 12, 2013.

- ^Groves, Martha (September 2, 1993). 'Intuit, Chipsoft Agree to Merge in $225-Million Deal'. Los Angeles Times. Retrieved December 29, 2016.

- ^Elliott, Justin (April 9, 2019). 'Congress Is About to Ban the Government From Offering Free Online Tax Filing. Thank TurboTax'. ProPublica. Retrieved April 9, 2019.

- ^Day, Liz (March 26, 2013). 'How the Maker of TurboTax Fought Free, Simple Tax Filing'. ProPublica. Retrieved April 9, 2019.

- ^Justin Elliott, Paul Kiel (October 17, 2019). 'Inside TurboTax's 20-Year Fight to Stop Americans From Filing Their Taxes for Free'. ProPublica. Retrieved October 17, 2019.

- ^Justin Elliott, Lucas Waldron (April 22, 2019). 'Here's How TurboTax Just Tricked You Into Paying to File Your Taxes'. ProPublica. Retrieved April 22, 2019.

- ^Justin Elliott, Kengo Tsutsumi (May 23, 2019). 'TurboTax Uses A 'Military Discount' to Trick Troops Into Paying to File Their Taxes'. ProPublica. Retrieved May 23, 2019.

- ^Elliott, Justin (May 10, 2019). 'New York Regulator Launches Investigation Into TurboTax Maker Intuit and H&R Block'. ProPublica. Retrieved May 23, 2019.

- ^Elliott, Justin (December 19, 2019). 'TurboTax Tricked Customers Into Paying to File Taxes. Now Several States Are Investigating It'. ProPublica. Retrieved December 30, 2019.

- ^Horn, Jonathan (November 9, 2014). 'Intuit: An atmosphere to excel'. The San Diego Union-Tribune. Retrieved December 29, 2016.

- ^'Corporate Profile'. Intuit. Retrieved December 12, 2013.

- ^'TurboTax Support: Audit Defense'. Intuit. December 6, 2013. Archived from the original on July 9, 2013. Retrieved December 12, 2013.

- ^'Intuit TurboTax Order Status FAQs (2009)'. Intuit. Retrieved December 12, 2013.

- ^'TurboTax Security Glitch May Force 150,000 Investors to Alter Passwords'. Los Angeles Times. April 6, 2001. Retrieved March 4, 2012.

- ^'Importing Your W-2, 1099, and 1098 Forms'. Intuit. September 9, 2013. Archived from the original on May 30, 2013. Retrieved December 12, 2013.

- ^Metz, Cade (October 1, 2003). 'Intuit's TurboTax Activation Scheme Irks Users'. PC Magazine. Retrieved June 13, 2007.

- ^'Why has the price of TurboTax increased by $15 this year?'. Intuit. Retrieved December 12, 2013.

- ^Elmblad, Shelly (November 25, 2008). 'TurboTax Removes E-file Fees'. About.com. Retrieved December 3, 2008.

- ^Ahrens, Frank (January 22, 2009). 'Treasury Pick Misfiled Using Off-the-Shelf Tax Software'. The Washington Post. p. D1.

- ^https://www.irs.gov/e-file-providers/about-the-free-file-program

- ^https://imgur.com/gallery/ErWicdl

- ^https://www.propublica.org/article/turbotax-just-tricked-you-into-paying-to-file-your-taxes

- ^https://www.businessinsider.com/turbotax-hr-block-cannot-hide-free-filing-services-irs-agreement-2020-1

- ^Becker, David (January 6, 2003). 'Intuit pours oil on TurboTax troubles'. CNET.

- ^ abDay, Liz (March 26, 2013). 'How the Maker of TurboTax Fought Free, Simple Tax Filing'. ProPublica.

- ^Burman, Len (April 15, 2013). 'The Tax Complexity Lobby'. Forbes.

- ^Matthews, Dylan. 'Why I'm boycotting TurboTax this year'. Vox. Retrieved April 1, 2017.

- ^'The Call for Boycotting TurboTax'. Institute for Policy Studies. Retrieved April 1, 2017.

- ^Novack, Janet (January 22, 2015). 'Intuit Offers $25 Refund To TurboTax Deluxe Users Hurt By Software Changes'. Forbes.

- ^'Intuit Cries Uncle, Will Reverse TurboTax Deluxe Changes'. Forbes. Retrieved November 24, 2015.

- ^'Citing Tax Fraud Spike, TurboTax Suspends State E-Filings'. Krebs on Security. February 6, 2015. Retrieved November 24, 2015.

- ^'TurboTax's Anti-Fraud Efforts Under Scrutiny'. Krebs on Security. February 22, 2015. Retrieved November 24, 2015.

- ^Adamczyk, Alicia (March 17, 2021). 'TurboTax and H&R Block said they worked with the IRS to fix stimulus check deposit issues. Customers say they still can't access the funds'. CNBC. Retrieved March 18, 2021.

External links[edit]

- Official website (paid tax filing)

- IRS Free File Program on Intuit official website (free tax filing)

Intuit TurboTax Deluxe 2020 with (R8 Update – 2020.48.08.27) + Cracked.dll | 368.15 MB/Intuit TurboTax Premier 2020 with (R8 Update – 2020.48.08.27) + Cracked.dll | 368.15 MB/Intuit TurboTax Deluxe / Premier 2020 (Latest Patch Only – 2020.48.14.58) | 1.55 MB

Get a head start on your 2020 taxes. File your tax return electronically to receive your fastest tax refund possible. Connect with an expert in a click and get answers when you need them with SmartLook™. Every personal TurboTax return is backed by our Audit Support Guarantee for free one-on-one audit guidance from a trained tax professional. And much more!Guidance for homeowners

Your biggest investment might also be your biggest tax break-mortgage interest, property taxes, and more.

Deduction finder

We’ll search for more than 350 tax deductions and credits to get you the biggest tax refund-guaranteed.

Complex life, simplified taxes

We’ll guide you through life changes and their impact on your taxes, so you get every tax deduction and credit.

Deduct your donations

We’ll help you track and value items you donate to charities with ItsDeductible™.

Audit Risk Meter™

Reduce your chance of a tax audit when we check your return for audit triggers and show your risk level.

Guidance for homeowners

Your biggest investment might also be your biggest tax break-mortgage interest, property taxes, and more.

Deduction finder

We’ll search for more than 350 tax deductions and credits to get you the biggest tax refund-guaranteed.

Deduct your donations

We’ll help you track and value items you donate to charities with ItsDeductible™.

Complex life, simplified taxes

We’ll guide you through life changes and their impact on your taxes, so you get every tax deduction and credit.

Mac Download Folder

Audit Risk Meter™

Reduce your chance of a tax audit when we check your return for audit triggers and show your risk level.

Education tax credits

If you or your children attended college or trade school, we’ll help you find refund-boosting education tax credits and deductions (1098-E, 1098-T) for tuition, books, and student loan interest.

No tax knowledge needed

We’ll ask you easy questions about your year and fill in the right tax forms for you.

Personalized to your unique situation

We ask questions to get to know you. Then, based on what you tell us, we’ll search for every tax credit that applies to you.

Answers as you go

Free U.S.-based product support and easy-to-understand answers online 24/7.

Thousands of error checks

You won’t miss a thing, we’ll double-check your tax return for accuracy before you file.

Get tax deductions for your dependents

We’ll show you who qualifies as your dependent, and find tax-saving deductions and credits like the Child & Dependent Care Credit, Earned Income Credit (EIC), and child tax credit.

Finish your state return faster

Once you complete your federal taxes, we can transfer your information over to your state return to help you finish quickly and easily.

Go at your own pace-no appointment necessary

Finish your tax return in one visit or do a little at a time. We automatically save your progress as you go, so you can always pick up where you left off.

Automatic import of your W-2 and 1099 info

Automatically import your W-2 from over a million employers, and your 1099 tax form data from participating

financial institutions.

Get a head start

We’ll automatically import your information from last year’s TurboTax return to help save time and increase accuracy. We’ll even import personal information about you and your family if you prepared your taxes with TaxAct or H&R Block CD/Download software.

Up-to-date with the latest tax laws

When tax laws change, TurboTax changes with them, so you can be sure your tax return includes the latest IRS and state tax forms.

Your information is secure

We’re dedicated to safeguarding your personal information. We test our site daily for security, use the most advanced technology available, and employ a dedicated Privacy Team.

See your tax refund in real time

We display and update your federal and state tax refunds (or taxes due) as you do your income taxes, so you always know where you stand.

Free federal e-file for your fastest possible tax refund*

E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. Free federal e-file is included.

No money out of pocket

Skip the trip to your wallet. We can conveniently deduct any TurboTax preparation fees from your federal tax refund and have the remaining balance deposited directly into your bank account. Additional fees may apply.

Your tax refund, your way

Choose to receive your tax refund by check or direct deposit to your bank account.

Release Notes

System Requirements:

– OS: Windows 8 or later (Windows 7 not supported)

– RAM: 2 GB or more recommended.

– Hard Disk Space: 1 GB for TurboTax (plus up to 4.5 GB for Microsoft .NET 4.5.2 if not already installed).

– Monitor: 1024×768 or higher recommended.

Information:

* As there will be hundreds of different patch and online update to TT2020, base and updates will be hosted under one posting to make things simpler.

* First download link with R8 update does include base installer and latest manual update patch and my patch for this update patch version. However online updates will keep being released by Intuit, so that there’s a second link for the latest update.

* Second link under this post will always include the latest patch only. All you need is install base setup and R8 manual update patch from first link, after that opening TT application and accept to install online updates. Then using the latest patch only will do the work. Intuit don’t release manual update patch for each update, so that I depend on users’ help to be notified about the latest update to keep the latest patch up-to-date.

* Be noted that the installed version of your TT2020 application and patch must match. Otherwise application won’t start.

Detailed Feature List

https://rapidgator.net/file/be062e69e5ad393fa2e1189b26972c92/TT.Deluxe.2020.rarhttps://rapidgator.net/file/ea27df32d3350b0c8ac12d3736962916/TT.Premier.2020.rar

https://rapidgator.net/file/24f99c273914d9ba63634c8ef6996804/Patch.Only.2020.48.14.58.rar

https://uploadgig.com/file/download/aA70844c3735E23b/TT.Deluxe.2020.rar

https://uploadgig.com/file/download/6e8C7F32df285678/TT.Premier.2020.rar

https://uploadgig.com/file/download/66A6b2Ab9c91b98B/Patch.Only.2020.48.14.58.rar

Turbotax Deluxe 2018 Mac Download

http://nitroflare.com/view/8F7A91BE6129970/TT.Deluxe.2020.rar

http://nitroflare.com/view/98064EA4F713506/TT.Premier.2020.rar

http://nitroflare.com/view/27E3D2AA404755C/Patch.Only.2020.48.14.58.rar